Top 10 Most Googled Questions by First-Time Homebuyers in Los Angeles (2025)

Thinking about buying your first home in Los Angeles? You’re not alone. Every day, thousands of local renters and aspiring homeowners are turning to Google with the same questions you might be asking. In this blog, we break down the top 10 search questions trending right now—plus easy-to-understand answers, helpful resources, and your next steps.

1. How do I buy a house in Los Angeles with low income?

-

Quick Answer: You can buy with a lower income by using special programs like FHA loans or local down payment assistance.

-

Helpful Resource: L.A. Low-Income Purchase Assistance Program (LIPA)

-

Next Step: Get pre-qualified with a lender who knows LIPA and CalHFA programs.

2. Will mortgage rates go down in 2025?

-

Quick Answer: Experts predict rates may dip gradually, but not return to pandemic-era lows.

-

Helpful Resource: Freddie Mac Mortgage Rate Forecast

-

Next Step: Talk to a lender about rate locks, buydowns, or refinancing later.

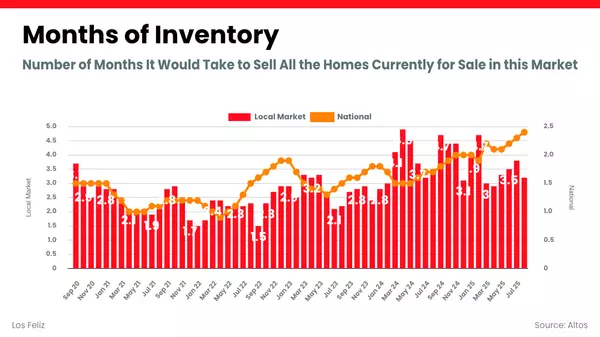

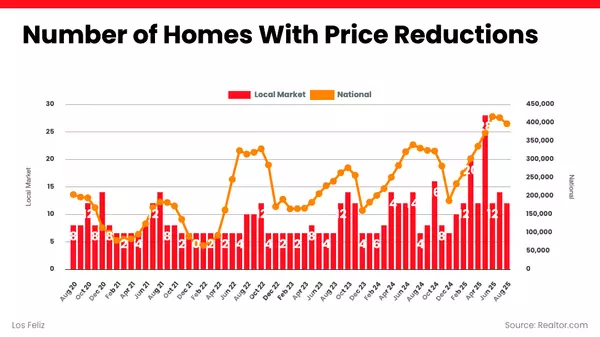

3. Will home prices drop in 2025 (Los Angeles)?

-

Quick Answer: Prices are expected to level off, not crash, thanks to tight inventory.

-

Helpful Resource: Redfin LA Market Data

-

Next Step: Shop smart in neighborhoods with long-term growth, not just the lowest price.

4. Is now a good time to buy a house in Los Angeles?

-

Quick Answer: The best time to buy is when you’re financially ready.

-

Helpful Resource: NerdWallet: Is Now the Right Time to Buy?

-

Next Step: Review your finances, savings, and loan pre-approval options.

5. What first-time homebuyer programs are available in LA?

-

Quick Answer: LIPA, CalHFA, and MyHome Assistance offer down payment help.

-

Helpful Resource: CalHFA First-Time Buyer Programs

-

Next Step: Attend a seminar or consult with a CalHFA-approved lender.

6. What are the best neighborhoods in Los Angeles for first-time buyers?

-

Quick Answer: El Sereno, Highland Park, Mar Vista, North Hollywood, and Woodland Hills are top picks.

-

Helpful Resource: 5 Best Places to Buy a Home in LA (2025)

-

Next Step: Visit open houses and compare prices, commutes, and community vibes.

7. What credit score is needed to buy a home in LA?

-

Quick Answer: FHA loans allow 580+ credit; conventional loans typically require 620+.

-

Helpful Resource: LendingTree Credit Score Guide

-

Next Step: Pull your free credit report and consult a mortgage advisor.

8. How much down payment do I need for a house in LA?

-

Quick Answer: You may only need 3–3.5% down with FHA or first-time buyer loans.

-

Helpful Resource: FHA Loan Down Payment Info

-

Next Step: Calculate your budget and ask about down payment assistance options.

9. Is it cheaper to rent or buy in Los Angeles?

-

Quick Answer: Renting is often cheaper monthly, but buying builds equity and long-term stability.

-

Helpful Resource: Rent vs Buy Calculator – NerdWallet

-

Next Step: Use a rent-vs-buy calculator to evaluate your financial outlook.

10. How do I start the home-buying process in Los Angeles?

-

Quick Answer: Step 1: Get pre-approved. Step 2: Find a local agent. Step 3: Start touring homes.

-

Helpful Resource: HUD’s Buying a Home Guide

-

Next Step: Schedule a buyer consultation to create a customized action plan.

Want more tips or help with your home buying journey? Reach out anytime—we’re here to help you take the first step with confidence.

We are Sarah & Branon Arlington with Rooster Homes,

When We Serve, You Succeed!

Categories

Recent Posts